01 Oct Thinkpiece

In this update:

-

- Where would you like to start?

- Your negative bias

Where would you like to start?

‘Where would you like to start?’ is an interesting question.

It’s as important a question too for investors. Because when talking to people about investments, the point at which you start has a material impact on the narrative.

Here’s a good example:

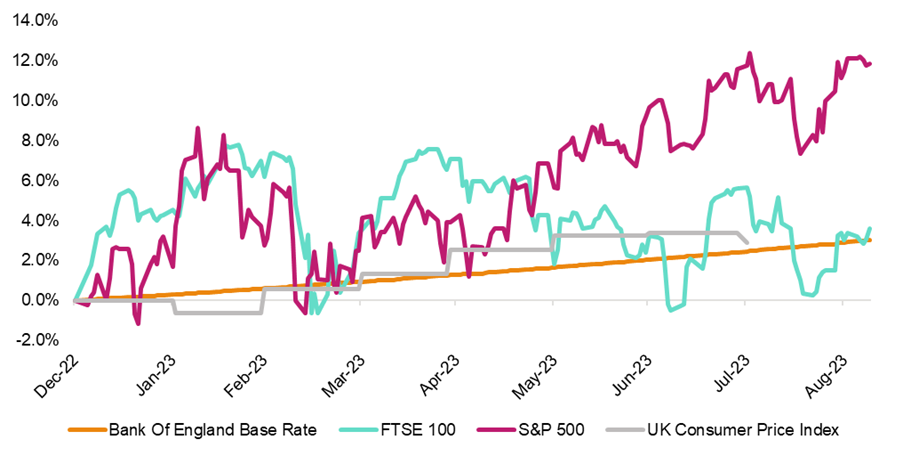

Story 1

The US equity market (S&P 500) has been UNSTOPPABLE. It has trounced other global equity markets, beaten cash and beaten inflation.

Source: 7IM/Factset

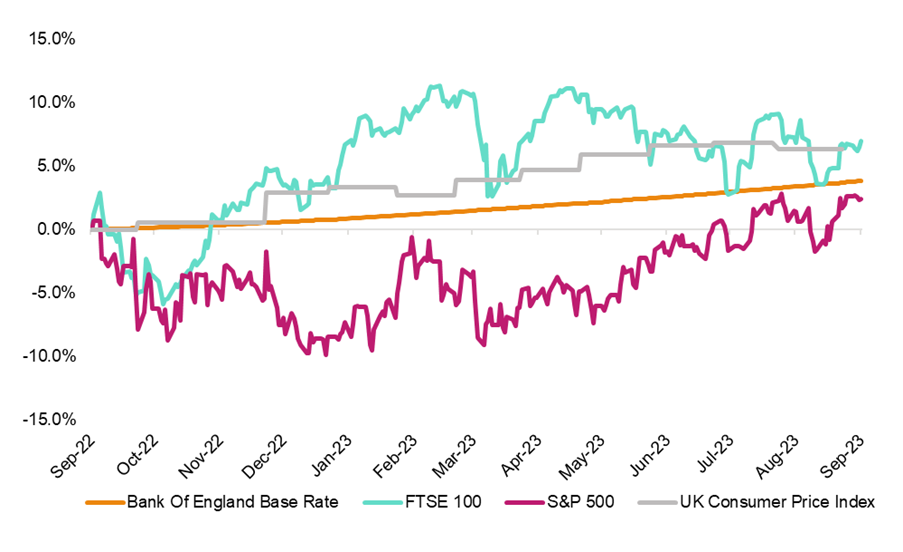

Story 2

The US equity market has been AWFUL. It has significantly underperformed its cousin the FTSE 100 and fallen well short of matching inflation; a high street current account could have beaten it.

Source: 7IM/Factset

Which of these is the true story? Well – both and neither. The first is Year-To-Date, while the second is the last twelve months. Both are incredibly common time frames in finance, but in most other walks of life would seem a bit arbitrary …

Year-To-Date is a period which could be anywhere from 1 day in length to 365 days in length!

And while twelve months seems a little more intuitive, look at the dates on the second chart. 19th September 2022 to 19th September 2023. Is that a period which matters? What if you looked one day earlier or later?

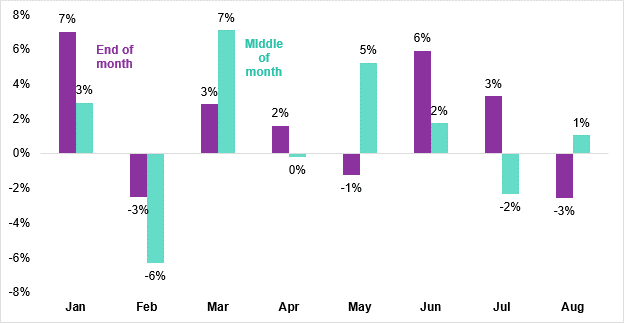

Let’s take a look at monthly returns so far in 2023, for the MSCI World equity index.

In purple shows the normal end of month to end of month data.

But if we used middle of the month to middle of the month (just two weeks) in green, the year looks completely different!

Source: 7IM/Factset

Accepting “standard” timeframes without thinking about them can have a material impact on how you view the world.

In the long run, investing is not about markets at all. Investing is about enjoying the returns earned by businesses.

John Bogle

Your negative bias

Your biology is engineered to attribute more weight to negative information and circumstances than it is to positive information and circumstances.

Go back thousands of years to cave dwellers. Imagine sitting one night over the camp fire, gazing out of the cave at the wonderful sunset.

If you fail to give your full attention to the pack of apex predators that are circling, ready to make you their evening meal, then you may not live to see another sunset!

So, it’s time to grab the spears and rocks, and fight for survival so that you see another day.

So, we’re understandably programmed this way.

However, when it comes to investment markets, we aren’t going to be eaten, but our long-held programming or ‘flight and fight’ response can unhelpfully spring into action.

This response is completely unhelpful when investing, as we can be tempted to flee at the first sign of negative news.

The market is awash with negative news, even when markets are flying high from their previous lows.

We are structured psychologically so that the negative has more impact than the positive does.

That’s a very difficult bias to work against when you’re in a situation where the positive should be dominating.

Jordan Peterson

‘The World is not ending’ Jordan B Peterson podcast

We call this emotional investing.

Regular monitoring of a portfolio is important as the financial markets evolve. It’s equally important for investors to manage their emotions to ensure they don’t follow the market’s ups and downs.

A common trope is for some investors to buy investments at market tops and sell them at market bottoms, particularly if they subscribe to the media narrative. That’s a good way to lose money.

The key to avoiding this trap is avoid both euphoric and depressive investment traps that can lead to poor decision-making.

Having access to a suitably qualified and trusted adviser who has lived through many ‘bear’ markets, can play a very important part in managing one’s response in challenging times.

However, no adviser is a magician. They can’t magically change the current situation, but they can help you to respond appropriately.

You will continue to suffer if you have an emotional reaction to everything that is said to you. True power is sitting back and observing things with magic. True power is restraint. If words control you, that means everyone else can control you. Breathe and allow things to pass.

Warren Buffett

If you’ve not yet put in place a sound financial plan and you’d like to know more, please feel free to contact us on 01626 305318 or via email here.

The views expressed are not to be taken as financial advice. Professional advice should be sought before proceeding.

Sorry, the comment form is closed at this time.