09 Nov Thinkpiece

In this update:

-

- Investing persists through all cycles

- Your retirement spend and your retirement duration

Investing persists through all cycles

Interest rates are at levels we haven’t seen since before the Financial Crisis, tempting some people into cash, and away from investing.

So does investing still make sense anymore? For those that follow this blog on a regular basis, I’m sure you’re responding with a resounding ‘Yes!’

It’s worth a reminder that the laws of capitalism haven’t changed, and don’t change depending on changes in the business and economic cycles. When interest rates are higher:

Governments have to pay higher returns than cash to borrow. Governments NEED to raise money through debt. It’s what keeps pensions paid and the lights on. If cash rates are at 5%, government bonds have to offer people MORE than that to tempt them out of the bank – even more so if they want them to lock it up for 10 years.

Companies have to pay more than governments to borrow. Companies NEED to incentivise you to lend to them, rather than to the government … which means paying you more than the government does! If cash is at 5%, and government bonds are at 6% (say)… corporate debt has to be higher (otherwise why take the risk?!).

Equities have to offer the chance of being paid more than corporate bonds. Companies ALSO need to generate money for their shareholders (who are taking even more risk than their bondholders). Because if their shareholders could do better leaving their money in the bank … soon there’d be no shareholders. And the decision maker at a company knows that. Any new project requiring a cash investment will be judged against the bank rate. If a new project doesn’t have the potential to beat what the bank’s offering, why do it?

The bottom line is that cash sets the bar. Everything else then needs to jump over it.

Of course, it’s tempting to believe that today’s investment circumstances are unique. “This time it’s different!”.

The four most expensive words in the English language are, ‘This time it’s different.’

Sir John Templeton

Inflation is higher than it’s been for a number of years. Government debt levels have soared. Geopolitical hotspots are flaring up in Ukraine, the Middle East and Taiwan. Add to that the transformational developments in AI and the increasingly savage impact of climate change.

But is it really different this time?

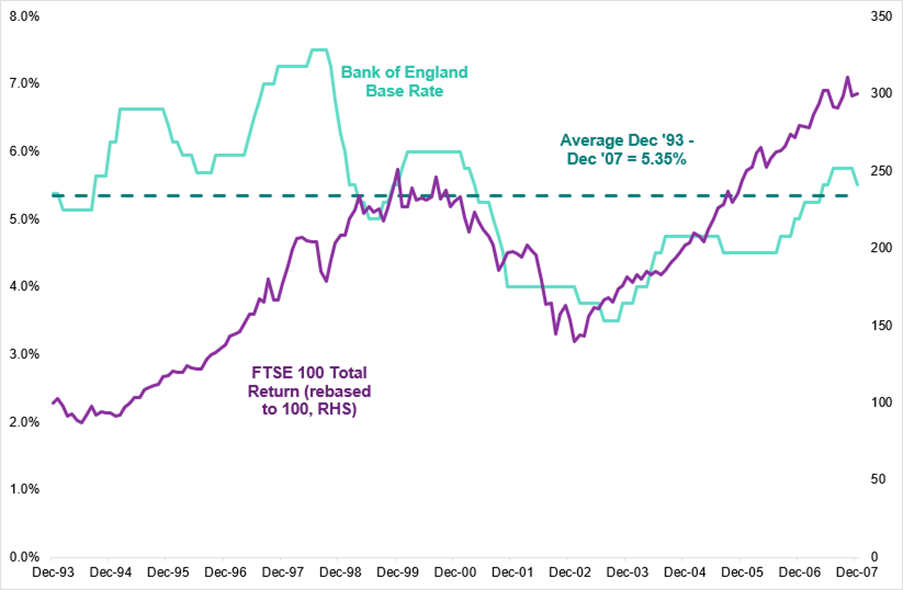

Take a look at the below chart. Between 1993 and 2007, interest rates averaged 5.35%. Government debt levels were rising sharply*. Geopolitical hotspots were flaring up in Yugoslavia, the Middle East and Russia. The internet was revolutionising society.

In the face of all that, surely just staying in cash, at 5.25%, was best? It would seem not.

*Source: 7IM/Factset

That higher cash bar created better jumpers. The FTSE 100 (with dividends reinvested) returned 8.1% annualised over that period.

The world continued to jump over the bar… and it will do in the next economic cycle too.

Your retirement spend and your retirement duration

Retirement, for many, may be a date. In reality it is a chapter, and for some, a long chapter in one’s life.

Let’s assume that you have worked very hard to build up a retirement pot. You’ve invested £250 per month into your pension fund for 35 years. Your pot has grown at a rate of 7% per annum after all costs and charges over the term and you’ve ended up with a pot valued at £450,263.65.

Like some people early in retirement, that can seem like a lot of money, but typically for a medium risk investor (under our firm’s definition) we’d suggest that a level of sustainable annual withdrawal is no greater than 4% per annum. In this instance, that’s £18,010.54 per annum.

Of course we would always say don’t draw what you don’t need. Leave it, if you don’t need it, with the potential to compound.

The first rule of compounding is to never interrupt it unnecessarily.

Charlie Munger

………….but we don’t work like that do we! We can typically ‘have a list’ of things we would like to do very early on in our retirement ‘whilst we still have our health’.

A new kitchen, a motorhome, those special holidays we always promised ourselves, giving the children money, a new car, a new boat, a new hobby…………the list is endless.

So we set about to ‘have a good time’, living solely for today. That may be fine, if you have other resources. Many do not and so we can quickly lose perspective of what’s appropriate and ‘spend away’.

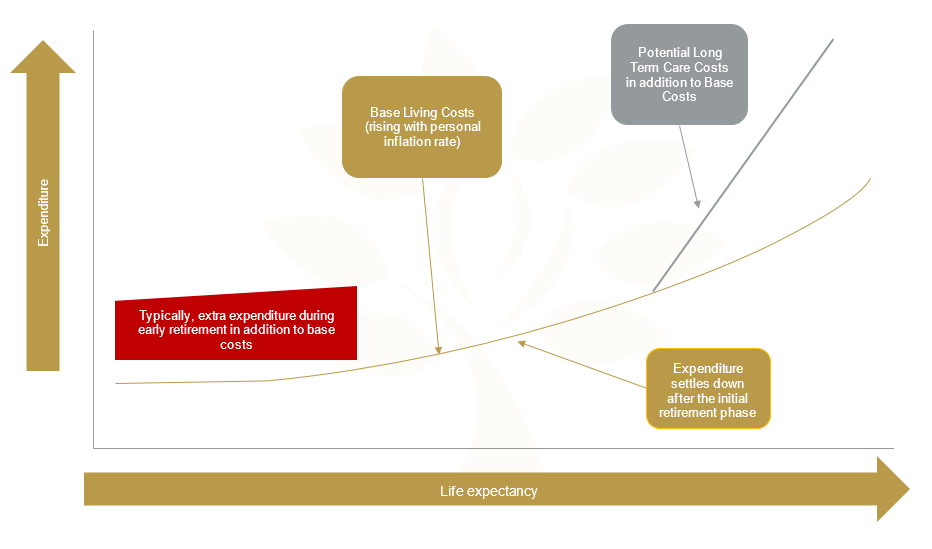

Retirement can then typically look like this:

That extra spending indicated by the red box can come in the early part of retirement. Retirement however, could last for many years. We don’t want to outlive our money.

For a male aged 65 in England, in 2019 they had a life expectancy of just over 84 years, and on the same basis, for a female it would be over 86 years*.

*Source: Office for National Statistics

So if we spend a significant proportion of our pension pot early on, and there are many things that we want to spend the money on, we leave ourselves with less funds to compound for the future.

For the 65 year old female in our example above, 1 year represents 4.65% of her overall remaining estimated life expectancy. Let’s say she wishes to spend £50,000 in her first year, paying for her living costs, perhaps some good holidays, some home improvements and maybe, just maybe, a modest motorhome, she would have spent 11.1% of her pension pot. So that’s 2.77 times the ideal level of drawdown.

As a consequence, her nest egg looks somewhat smaller, resulting in a pot value now of £400,263.65 (assuming that markets haven’t moved up or down). Using our 4% drawdown example, that then results in a lower drawdown level now of £16,010.54 per annum. She’s reduced her annual drawdown by £2,000 per annum, potentially for the rest of her retirement!

So by bringing her income ideally designed to draw in future years, into the current year, she could put the rest of her retirement sustainability into jeopardy. In addition, one should remember that investment returns are certainly not linear. They are irregular. Markets do not provide a fixed return on a predictable basis.

Add that into the equation and one needs to be very careful indeed that one doesn’t make irrevocable choices that affect what is, for many, a holiday you should never come back off!

The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioural discipline that are likely to get you where you want to go.

Benjamin Graham

Your opportunity

If you’ve not yet put in place a sound financial plan and you’d like to know more, please feel free to contact us on 01626 305318 or via email here.

The views expressed are not to be taken as financial advice. Professional advice should be sought before proceeding.

Sorry, the comment form is closed at this time.