19 Feb Thinkpiece

In this update:

- Latest Retirement Living Standards

Latest Retirement Living Standards

The latest update to the Pensions and Lifetime Savings Association (PLSA) Retirement Living Standards (RLS) reveal a shift in the cost of retirement living driven by changes in the UK public’s expectations and increases to the cost-of-living.

The latest research reflects the price rises that households have faced, particularly in food and energy use. It also highlights the increasing importance people place on spending time with family and friends out of the home, as people’s priorities have changed following the pandemic. This switch, and the associated costs are reflected in the updated levels.

The RLS describe the cost of three retirement lifestyles: Minimum, Moderate, and Comfortable. The research is based on multiple in-depth discussion groups with members of the public from all parts of the UK.

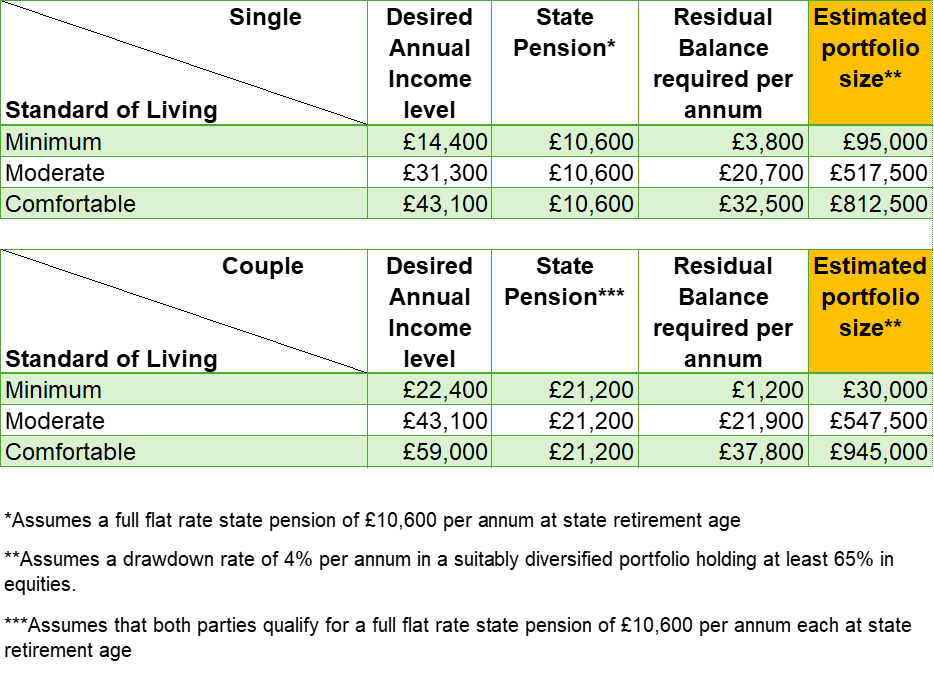

The updated Retirement Living Standards reveal increased costs across all levels, the Minimum level increased to £14,400 for a single person and to £22,400 for a couple. The Moderate level increased to £31,300 for a single person and to £43,100 for a couple. At the Comfortable level, the cost increased to £43,100 for one person and to £59,000 for a two-person household.

The really scary thing is that these levels of income are net of (after) tax and household costs – meaning that the figures assume you aren’t paying rent or a mortgage, or other liabilities!

The PLSA press release includes further details.

If we take this further and determine how much people would need to save in addition to their state pension(s) in order to achieve this level of income in retirement, we can arrive at a figure for the overall additional pension pot value that would be needed to support these standards of living:

Now there are a number of issues with such a simplistic calculation:

- The state pension is not payable until, for many, age 67 or 68. Often people want to begin to enjoy their retirement much sooner than this, at say age 60 or even earlier. This is the preserve of the very few. For the vast majority of people, this is not realistic and for many they may even need to continue working in retirement.

- Not everyone qualifies for a full flat rate state pension. Among other conditions, you must have at least 35 years of National Insurance (NI) contributions, and only then may get the full amount

- Tax is likely to need to be paid on the incomes indicated above, reducing the net income available in retirement.

- You may feel that the sums for ‘minimum’, ‘moderate’ and ‘comfortable’ retirements indicated above are much lower than your own ideal or desired level of income in retirement.

- People often have other demands on their pension pots, often planning that one-off expensive holiday, buying a motorhome, doing work on their property, helping their children financially, down or upsizing and so on. These costs will eat into the residual ‘income’ drawn from a portfolio (illustrated at 4% per annum).

As the saying goes ‘Some people would rather have £5 today than £15 next year!’

- If you draw at more than 4% per annum from a typical medium risk portfolio (as defined by us), you risk eating away at your underlying capital.

- Based on research conducted by the government, the average pension pot is £37,600. That would provide an income of around £1,500 per annum, which is woefully inadequate!!

- Your own personal inflation rate may be much higher than the rate at which the state pension increases by.

- The government is now considering rules to allow people to draw some of their pension pots earlier, or access them to pay off debts. That will leave less available for retirement, and less retirement income.

Only those willing to accept the discomfort of investing

will fully realise the benefits.

Peter Blackburn

Save for large inheritances, or significant pension schemes provided by employers, planning early enough, and for long-enough is the only strategy that can begin to approach the levels of income indicated above.

Your opportunity

If you’ve not yet put in place a sound financial plan and you’d like to know more, please feel free to contact us on 01626 305318 or via email here.

The views expressed are not to be taken as financial advice. Professional advice should be sought before proceeding.

Sorry, the comment form is closed at this time.